Insurance Claims

- Home

- Insurance Claims

Insurance Claims

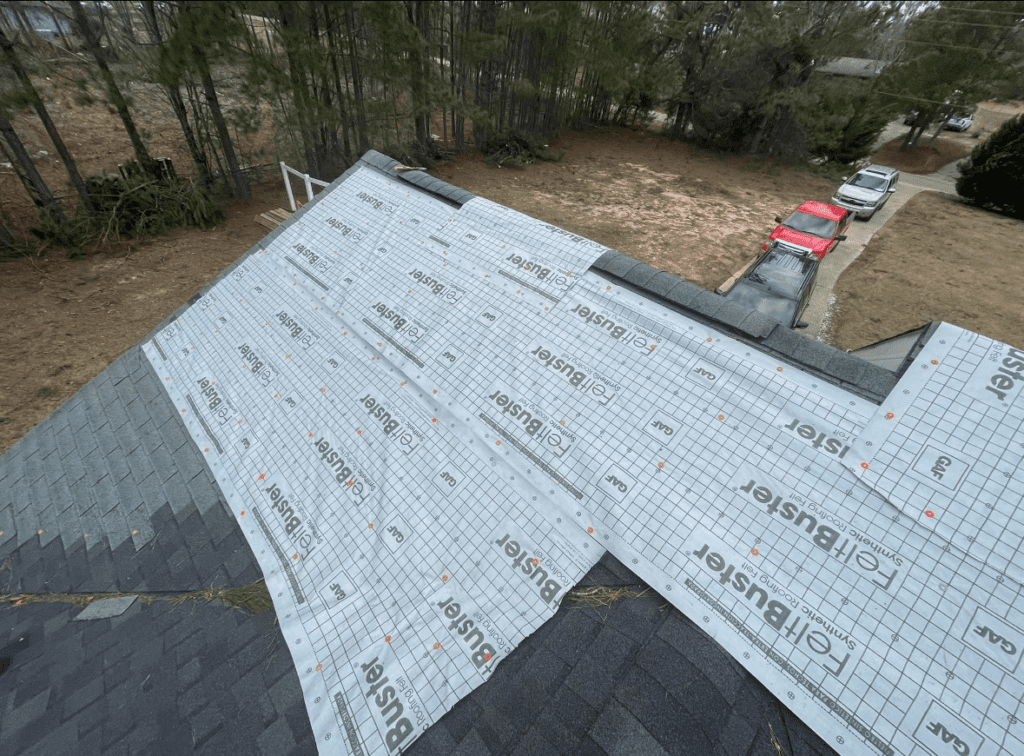

Insurance claims are formal requests made by policyholders to their insurance company for compensation or reimbursement for losses, damages, or injuries covered under their policy. The process typically involves submitting documentation and evidence, such as photos, repair estimates, or medical records, to support the claim. Insurance companies then assess the claim, determine its validity, and decide on the payout amount. Filing a claim can help individuals or businesses recover financially from unexpected events such as accidents, property damage, or health issues. Proper documentation and understanding of the policy terms are crucial for a successful claim.

Expert assistance in navigating insurance claims, helping you get the coverage you deserve with detailed documentation and support.

- Helps policyholders recover financially from unexpected events, reducing the impact of losses or damages.

- Provides a safety net against risks, such as property damage, accidents, or health issues, ensuring protection for individuals and businesses.

- Knowing that coverage is in place can provide reassurance that financial support will be available in case of unforeseen circumstances.

- Insurance claims enable faster recovery by covering repair or replacement costs, medical expenses, or business interruptions.

- Some insurance policies offer additional support, such as legal services or medical care, as part of the claim process.